The Sustainability Accounting and Financial Performance of Quoted Food and Beverage Manufacturing Companies in Nigeria

Purpose of the Study

The main objective of this study is to evaluate the sustainability accounting and financial performance of quoted food and beverage manufacturing companies in Nigeria. The specific goals include the following:

- To investigate the effect of social accounting on the return on assets of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of social accounting on earnings per share of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of environmental accounting on the return on assets of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of environmental accounting on earnings per share of food and beverage manufacturing companies in Nigeria.

CHAPTER 1: INTRODUCTION

1.1 Background to the Study

In the global business and economic contexts, long-term sustainability has become very important as a basis for investment decisions, and consumers are growing more conscious of the social and environmental performances of the entities from whom they buy goods and/or services”. They also mentioned the stakeholders being concerned more about the social responsibility and environmental friendliness of Companies apart from their economic performance. Long gone are the days when investors and other stakeholders get satisfied with the profitability, dividend payment, and other financial performance indicators. Highly integrated and relevant information is the requirement of a broad base of stakeholders (Ho & Taylor, 2014).

Thus, there has been an increased awareness between companies and the environment in which they operate, this enlightenment has been sharpened by concerns about resources depletion, resources scarcity, environmental degradation, and the depletion of the ozone layer and that is causing an imbalance in the environmental system for sustainable development for the next generation (Pramanil, Shil, and Das, 2011). Saale (2007), in his report, opines that an essential drift in the production and operation of modern business is the ever-amplifying concern for environmental, ethical, and workplace diversity issues. Business development has a social and environmental impact that cumulates in the social hitch, global warming, actual disaster, and pollution. To this extent, congeries of business firms accept much responsibility for social and ecological issues as they do for economic issues. A prime reason for this is that business organizations are reflecting growing social aspirations and stakeholders’ concerns (Nnamani, Onyekwelu&Ugwu, 2017).

According to Pramanil, Shil, and Das (2011), sustainability accounting, a business philosophy that refers to best reporting practices that promote and call for sustainable development is on the speed-lain to acquiring momentum in recent times and most especially, the harmonization and adoption of international financial reporting standards (IFRSs) and compliance with other environmental regulations enacted to encourage green operation, emphasizing more disclosure requirement is actively shaping a reporting system that gives prominent focus to the effect of firm’s operation on the society at large ( people and ecology). Sustainability accounting entails systems, methods, and processes of creating sustainability information for transparency, accountability, and decision-making purposes. This includes the identification of relevant sustainability issues of the company, the definition of indicators and measures, data collection, overall performance tracking, and measurement, as well as the communication with internal and external information recipients. Sustainability accounting can be defined as the integration of reporting and accounting for social, environmental, and economic issues in corporate reporting. This is also what is known as “Tripple Bottom Line” reporting.

Sustainability practices draw the attention of firms to issues such as resource usage, waste treatment, carbon emissions, water pollution, employee welfare, and other unethical issues. It has been argued by many scientists and researchers that human activities mostly conducted for profit motives by business entities are acknowledged as having the greatest impact on society such that have led to global warming and earth damage, causing an ever-growing unsustainable environment (Unerman&O’Dwyer, 2007). Failing to manage these sustainability issues can substantially damage or destroy the reputation of a company and consequently affect its performance. The concept of sustainable operation describes the integration of profit and efficiency orientation of traditional operation management with a vast consideration of the firm’s internal and external stakeholders and its environmental impact. Today’s superior opinion dictates that the era wherein a firm’s performance was predicated on its financial performance alone becomes superannuated in recent times. Resource providers are interested to underscore the relationship between companies and their host communities, staff, and ecology to be armed with quality information for informed ethical investment decisions (Adekanmi, 2015).

According to Ghoul (2011), social and environmental reporting is the process of communicating the social and environmental effects of an organization’s economic actions to particular interest groups within society and the society at large. It involves extending the accountability of organizations beyond the traditional role of providing a financial account to the owners of capital, in particular, shareholders. Such an extension is predicated upon the assumption that companies do have wider responsibilities than simply to make money for their shareholders. According to the Brundtland report of 1987, sustainable development which is anchored on three cardinal pillars the environmental pillar, the social pillar, and the economic pillar was described as the ability to meet the need of the current generation without compromising the ability of future generations to survive and meet their own needs.

Sustainability accounting includes both financial and also social and environmental aspects. It emphasizes non-financial information, which is closely linked to sustainable development. Sustainability accounting includes more than just economic events, value and non-financial expressions, responsibility to a broader group of stakeholders, and must explain much more than financial achievements. It is in the stages of evolution and its application of it is not considered simple. Sustainability reporting helps to alleviate the long-term goal consequences connected with shortage of resources and while trying to maximize the value of the firm, they are expected to minimize the negative impact on the environment and society. Many organizations across the world have undertaken sustainability activities including reduction of waste and harmful emissions, conservation of energy, optimum utilization of scarce resources, promotion of employee welfare, and community support services. Examples of sustainability programs undertaken at various companies include Stakeholder engagement in PepsiCo, Employee engagement in General Electric, Water stewardship in Coca-Cola, Supply chain management in Ford Motor Company, Innovation in Nike, Executive compensation in Exelon, Biodiversity in PG & E, Investor dialogue in Starbuck’s, Greenhouse gas emission reductions in Adobe, Buildings, and facilities in Bank of America, Human Rights in Johnson and Johnson, Transportation in Walmart, Design in dell, Investment in sustainable products and services: Procter and Gamble, etc (Kleindorfer, Singhal &Wassenhove, 2005).

Most studies on sustainability accounting and reporting are focused on developed countries with others skewed to the oil and Gas industry in Nigeria. Other related inquisitions on the object of study have concentrated particularly on the environmental taxonomy of sustainability practices for manufacturing firms in Nigeria. Meanwhile, some were also conducted in view of the relationships of variables of the study. To this extent, there is a dearth of empirical studies on the effect of sustainability accounting on the financial performance of quoted food and beverage manufacturing firms in Nigeria with a particular interest in food and beverage companies.

1.2 Statement of the Problem

Despite the huge attention given to sustainability and social accounting by the Nigerian government which entails on a policy of self-regulation, adherence to rules and regulations, ethical standards, environmental responsibility and sustainability, consumers’ satisfaction, employee welfare, communities, and stakeholders’ benefits. Companies are yet to claim responsibility and contribute reasonably towards environmental improvement and sustainability. In the same vein, companies are also accosted to increase investors’ stake which is usually achieved via profit maximization objective. On account of this, scholars who brace up for sustainability reporting have maintained that companies with the configurative framework and intent necessary to entrench deep-seated sustainability capability and capacity into their organizational culture will possess the driver’s seat (Shelly & Lisa, 2007). Furthermore, many manufacturing companies in Nigeria are usually confronted with social issues such as youth restiveness largely attributed to unemployment and a dearth of social amenities.

Nigeria, therefore, is at a moment in its history where it is gripped by economic recession whereby all must be incited to engage in productive ventures so as to revitalize the economy hence, the production sector cannot be left unwatched. The manufacturing sector is to this end of paramount importance due to the high employment capacity it provides to the teeming Nigerian populace and so should be guided with zealousness as a negative impact on the sector may spell an extensive multiplier effect on the Nigerian economy. Sustainable practices become imperative for long-term survival.

In view of the above-predicated assertions, this study is aimed at examining sustainability accounting has on the financial performance of selected quoted food and beverage manufacturing companies in Nigeria.

1.3 Conceptual Framework

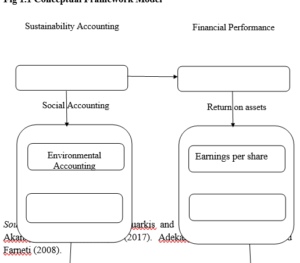

The independent variable of the stated topic is “Sustainability Accounting” with its dimensions of social accounting and environmental accounting whereas the dependent variable is “Financial Performance” with its measure of earnings per share and return on assets.

Fig 1.1 Conceptual Framework Model

Conceptual Framework Source of conceptualization: Zhuarkis and Lai, (2012); Charles, John-Akamalu, and Umeoduagu, (2017). Adekanmi, (2015). Guthrie and Farneti (2008).

1.4 Purpose of the Study

The main objective of this study is to evaluate the sustainability accounting and financial performance of quoted food and beverage manufacturing companies in Nigeria. The specific goals include the following:

- To investigate the effect of social accounting on the return on assets of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of social accounting on earnings per share of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of environmental accounting on the return on assets of food and beverage manufacturing companies in Nigeria.

- To investigate the effect of environmental accounting on earnings per share of food and beverage manufacturing companies in Nigeria.

1.5 Research Questions

- To what extent does social accounting on return on assets of food and beverage manufacturing companies in Nigeria?

- To what extent does social accounting on earnings per share of food and beverage manufacturing companies in Nigeria?

- To what extent does environmental accounting on return on assets of food and beverage manufacturing companies in Nigeria?

- To what extent does environmental accounting on earnings per share of food and beverage manufacturing companies in Nigeria?

1.6 Research Hypotheses

Ho1: There is no significant relationship between social accounting and return on assets of food and beverage manufacturing companies in Nigeria.

Ho2: There is no significant relationship between social accounting and earnings per share of food and beverage manufacturing companies in Nigeria.

Ho3: There is no significant relationship between environmental accounting and return on assets of food and beverage manufacturing companies in Nigeria

Ho4: There is no significant relationship between environmental accounting and earnings per share of food and beverage manufacturing companies in Nigeria.

1.7 Scope of the Study

Content Scope: This study will be centered on sustainability in accounting and financial performance with emphasis on social accounting, and environmental accounting, as dimensions, whereas the return on assets and earnings per share as measures.

Geographical Scope: The study will be geographically centered in Nigeria.

Unit of Analysis: The analytic scope covered the period of six (6) years, ranging from 2011-2017 of seven (7) quoted food and beverage manufacturing companies in Nigeria.

1.8 Significance of the Study

In the light of growing concern on sustainable development, this study will help to enhance the understanding of the problem that is genetic to unsustainable business practices that have, and will potentially spell myriad catastrophes in society if not addressed appropriately.

Adequate comprehension of the dynamics that exist between sustainability accounting and financial performance will superintend, streamline and strengthen policy options and hence facilitate the implementation of befitting sustainability measures to stimulate socio-economic development.

It will also in like manner enable corporate firms in the food and beverage manufacturing industry to underscore that engaging in these sustainability narratives and reporting on their social, environmental, and economic performance will not only enhance their corporate performance but also elevate their position as market leaders, all contributing to their standing with officials and community in which it operates in terms of their image and public perception on sustainability rehearse.

It is no gain saying that society by and large is entirely not informed about the concept of sustainability and its benefits due to a lack of a clear understanding of what it represents. The study would therefore assist to raise society’s awareness on the subject matter such that would inject the sensitivity to begin to seriously demand and hold companies accountable for their environmental and social footprint. Similarly, it will also help the regulatory authority develop clearly defined and implementable social and environmental guidelines to be complied with by companies as responsible corporate entities.

The study will also serve as a base from which inferences can be drawn with respect to other sectors of the economy. Not to say the least, it will also ignite the interest of other researchers to undertake other related studies on this area thereby adding to the existing stock of knowledge.

Reviews

There are no reviews yet.